5 Shades of Grey in GST

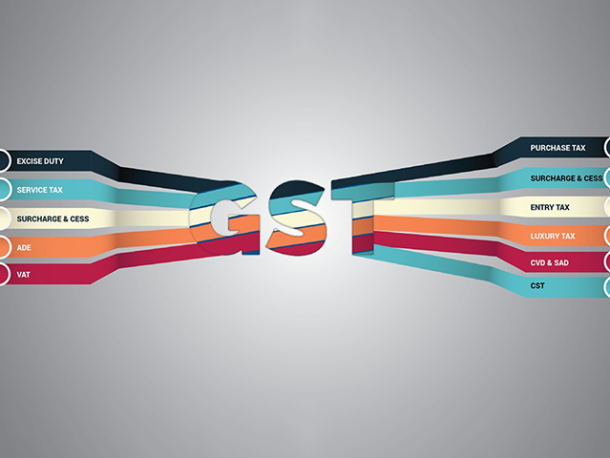

GST was launched with much fanfare at midnight, July 1, 2017 replacing 17 erstwhile laws, both Central and State level.…

GST was launched with much fanfare at midnight, July 1, 2017 replacing 17 erstwhile laws, both Central and State level.…

The recent ruling pronounced by the GST Authority for Advance Rulings, Kerala on the taxability of recoveries made from employees…

Draft model law released on June 14, 2016 for public opinion, comprising of: GST Act, 2016 covering both Central law…

One thing is clear — elections are in sight! Besides projecting numbers, the Finance Minister’s opening speech flags key achievements…

Withholding tax provisions in Indirect Tax - pre-GST regime Withholding tax (‘WHT’) at source by a payer from amounts payable…

“GST has opened a host of opportunities, as equally challenges, for the manufacturing industry. Based on our experience with manufacturers…

Input Tax Credit (ITC) is the backbone of the GST regime. GST is nothing but a value added tax on…

“Return” is a statement of specified particulars, relating to business activity undertaken by the taxable person during a prescribed period.…